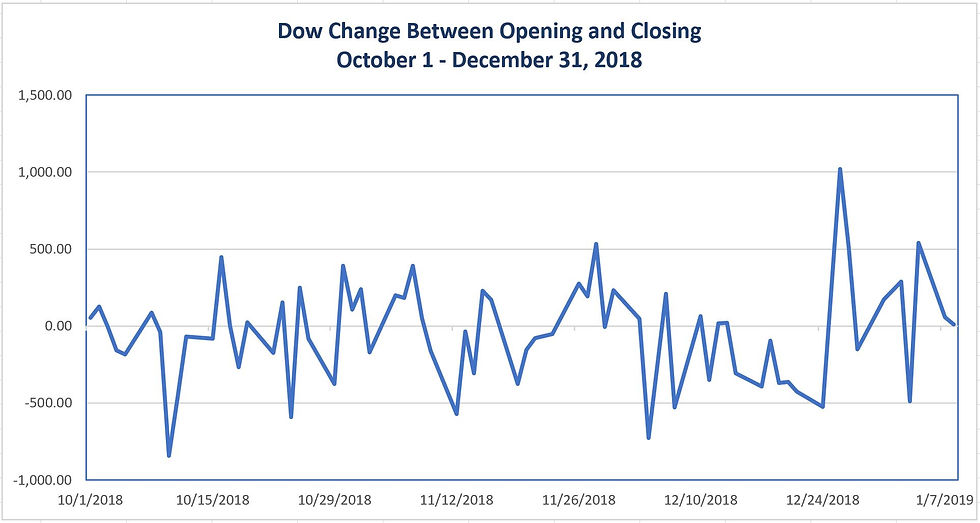

It’s impossible to miss the wild, record swings in the stock market. Scary things for investors accustomed to more sensible market behaviors. Expert commentators quickly pointed to traditional factors including higher interest rates, a potential slowdown of the world economy, and trade tensions. These explanations haven’t been convincing, given that the U.S. economy is strong and that previous periods of instability didn’t lead to similar sustained, record-breaking volatility. Traditional expert insights, anchored to history and personal experience, are being rendered increasingly obsolete by the relentless march of technology – particularly Artificial Intelligence, machine learning and automated trading. Human experience and intuition are fading as data and algorithms ascend.

In fairness, human analysts have had centuries to dazzle clients with prescient advise, much of which historically missed their mark. It led Princeton University professor Burton Malkiel to conclude in his 1973 best seller, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper's financial pages could select a portfolio that would do just as well as one carefully selected by experts.”[1] Now it’s the turn of machine learning experts, mathematicians, and software engineers to demonstrate that their solutions will outperform monkeys and human investment advisors alike.

Analysis and trading in real-time

Autonomous trading systems rely on AI and machine learning (ML) technologies to sift through millions (sometimes billions) of trading records and general market data. They use mathematical models, statistical analysis, and other methodologies, including sentiment analysis (SA) based on natural language processing (NLP). NLP estimates sentiment by processing descriptors, emotional and opinion language published on the web, social media, company reports, etc. These systems continuously capture and analyze streams of data and information to make near real-time predictions of stock and market trends. Those predictions then drive trading decisions, which are automatically executed in milliseconds.

The proliferation of autonomous trading systems, which account for over 80% of current trades, has correlated with growing market volatility. According to JPMorgan, “fundamental discretionary traders account for only about 10% of trading volume… The majority of equity investors today don’t buy or sell stocks based on stock specific fundamentals.”[2] Modern stock markets are being reshaped into systems-of-systems environments where components (individual autonomous trading systems) influence each other, without being physically connected. Those influences are often disconnected from traditional stock, market and economic performance factors.

Consider an autonomous trading system whose machine learning algorithms respond to changes in target variables by almost instantly selling (or buying) large blocks of stocks. Other systems detect the changes and trading activities, and their algorithms are influenced into triggering similar trades, which in turn affect other systems, and so on. The process accelerates until factors including sentiment calculations change and reverse trading trajectories. These behaviors reflect a kind of algorithmic consensus that converges on shared predictions, “the market is headed up (or down),” and decisions, “buy (or sell) blocks of stocks.”

Summary and implications

Stock markets are being reshaped and disrupted by innovative AI technologies. Human analysts are being marginalized by the speed with which systems can analyze large datasets and make autonomous trading decisions. The chattering we don’t hear is happening in the digital space, where systems interact and influence each other in unpredictable ways. That’s the nature of complex-adaptive, systems-of-systems environments where small, localized changes can have large systemic impacts.

Stock markets may become the first social institutions run by directed AI technologies with only limited human involvement. Their large datasets and instantaneous analytical requirements make them unsuitable for human analysis and decision-making. How they will be regulated and by whom are open questions. It’s unclear who would be held accountable when autonomous system decisions result in large disruptions, massive losses, and financial instability. In complex environments, where systems interact and influence each other without human direction, assigning credit or blame for unforeseen outcomes is often impractical.

It’s impossible to predict how autonomous trading systems will continue affecting stock exchanges in the years ahead. What’s certain is that their underlying processes will have little in common with those that preceded them when human traders executed most trades. Ultimately, people may no longer have a role to play on trading floors. In their place will be cloud-based centers where computers employ methodologies like machine learning to execute investment strategies without much human involvement. In their wake, oversight, management, and accountability will also be redefined leaving regulators to figure out how they can step in during periods of growing instability, given that autonomous systems can execute massive trades in the blink of an eye.

References

[1] Rick Ferri, Any monkey can beat the market, Forbes, February 12, 2012, https://www.forbes.com/sites/rickferri/2012/12/20/any-monkey-can-beat-the-market/#240a7b81630a

[2] Evelyn Cheng, Just 10% of trading is regular stock picking, JPMorgan estimates, June 13, 2017, CNBC, https://www.cnbc.com/2017/06/13/death-of-the-human-investor-just-10-percent-of-trading-is-regular-stock-picking-jpmorgan-estimates.html